Deep Dives on Rolls-Royce PLC (LON:RR)

“Nothing after the Battle of Britain in the summer and autumn of 1940 was quite as dramatic but, as we know, Britain came perilously close to losing the war, which dragged on for another five years. Merlin-powered aircraft continued their front-line involvement throughout the world for the whole of those five years.”-The Magic of a Name: The Rolls-Royce Story, Part-1 by Peter PughIn the records of British history, few companies are as ineradicably linked with the nation’s defence as Rolls-Royce. The magic behind its name came not only from producing luxury cars but from a wartime legacy that played a pivotal role in both World War I and World War II. Rolls-Royce's commitment to innovation and quality proved vital to Britain’s aerial and ground forces, positioning it as a requirement in the nation's quest for victory.

Rolls-Royce began as a car manufacturer in 1906, notably with the 40/50 H.P. model, famously known as the Silver Ghost. Introduced in 1906, the Silver Ghost was celebrated for its exceptional engineering and reliability, earning the moniker "The Best Car in the World."

Speaking at the opening, Charles Rolls (one of the founder from the name “Rolls-Royce”) outlined the company's policy of accelerating by going slowly:

“Instead of turning out cars in huge quantities at a low price, we are turning out comparatively a small number of cars by the very best and most careful methods of manufacture. It is, in fact, the comparison between the ordinary watch and an English lever.”

By the 1920s, Royce's (another founder from the name “Rolls-Royce”) reputation was such that he was asked, almost ordered, by the Government to design an engine for Britain to retain the Schneider Trophy (The Magic of a Name: The Rolls-Royce Story, Part-1 by Peter Pugh, page-7).

Founders of Rolls-Royce (left, right, In the middle Mr Johnson who brought them together) ; source-Rolls-Royce web

The Schneider Trophy was an international competition established in 1912 by Jacques Schneider, a French financier and aviation enthusiast. The trophy, officially known as the Coupe d'Aviation Maritime Jacques Schneider, was awarded to the

Silver Ghost Car-1906; Source Rolls-Royce

fastest seaplane over a fixed course. The competition aimed to encourage advancements in civil aviation, but it quickly became a contest for pure speed.

The races were held twelve times between 1913 and 1931. Britain won the trophy permanently in 1931 by meeting the condition of winning three consecutive races. The Schneider Trophy played a significant role in advancing aircraft design, particularly in aerodynamics and engine technology, influencing the development of World War II fighters like the British Supermarine Spitfire and the American North American P-51 Mustang.

Merlin Engine 1930s; Source Rolls Royce Web

The Rolls-Royce Merlin engine was first designed and ran by Rolls-Royce in 1933 as a private venture. Initially known as the PV-12, it was later renamed "Merlin" following the company's tradition of naming its piston engines after birds of prey.

As the threat of another world war loomed, Rolls-Royce’s Merlin engine became central to Britain’s defence strategy. The

Modern Version of Aero Engine; Rolls-Royce

Merlin was a powerful V-12 engine initially developed in the 1930s as an evolution of the earlier engines. When war broke out in 1939, Rolls-Royce rapidly increased production to meet the desperate need for more powerful and reliable aircraft engines.

The Merlin found its place in some of the most iconic aircraft of the war, including the Supermarine Spitfire and the Hawker Hurricane. These fighter planes, powered by Merlin engines, were integral to the Battle of Britain in 1940. The Spitfire, with its agility and speed, became a symbol of British resilience, while the Hurricane’s robustness allowed it to absorb damage and keep fighting. Both aircraft were instrumental in defending Britain against the German Luftwaffe, and it was the Merlin engine’s dependable power output that gave them an edge.

Beyond fighters, the Merlin also powered bombers like the Avro Lancaster, which played a crucial role in nighttime bombing raids over Germany. The Lancaster, with its impressive payload and range, owed much of its capability to the dependable thrust provided by the Merlin. In fact, Rolls-Royce's contribution to the war effort became so valued that Winston Churchill is reputed to have said, “The Battle of Britain was won on the Merlin.”

While Rolls-Royce is celebrated for its aero engines, its cars also served the British government during the wars. Rolls-Royce produced armored vehicles used by officers and generals for transportation across Europe. In World War II, Rolls-Royce’s Phantom III chassis served as the foundation for military armored cars, offering both reliability and durability in challenging conditions.

Additionally, some Rolls-Royce cars served in a more symbolic capacity. The British government used custom Rolls-Royce vehicles for diplomatic and ceremonial purposes, as they were seen as symbols of British pride and engineering excellence. Even in war, the company’s reputation for quality never wavered.

Through two world wars, Rolls-Royce proved itself as more than a car manufacturer. It became a lifeline for Britain’s air and ground forces, demonstrating the critical role of engineering excellence in national defence. The Merlin engine’s legacy is particularly profound, symbolizing how one company’s dedication to craftsmanship and innovation helped change the course of history.

This transformation marked Rolls-Royce as a leader in British engineering, with an enduring commitment to innovation and resilience. The emphasis on reliability, meticulous craftsmanship, and engineering excellence became the foundation of Rolls-Royce's reputation in both automotive and aerospace industries, honoring the vision of Rolls and Royce, who together crafted a legacy that lives on.

Price movement: Rolls-Royce (2009-2024), Source: Yahoo Finance

Today’s Transformational Journey

This journey of transformation continues. As I read the 2023 statement from chairman Anita Frew—who became the first female chair of Rolls-Royce in October 2021—and CEO Tufan Erginbilgic, appointed in January 2023, I was struck by their bold strategy for transforming the company. Over the past five years, Rolls-Royce has experienced ups and downs. From 2019 to 2021, the pandemic heavily impacted its Civil Aerospace division, with revenues plunging and restructuring needed to survive. By 2022, gradual recovery began in the Defence and Power Systems divisions, with a shift toward efficiency, cost optimization, and innovation under Tufan’s leadership.

As of 2023, Rolls-Royce has regained its footing with a market share of approximately 35% in the Civil Aerospace sector and ongoing defence contracts that strengthen its presence in military aviation and naval propulsion systems. The company’s commitment to sustainability through investments in sustainable aviation fuel (SAF) and small modular reactors (SMRs) also positions it well for future growth.

For many, the depth of this legacy might be unknown, but that's where Finota steps in. Every month, we provide in-depth analyses of London Stock Exchange-listed companies, written in simple language, so you can understand stocks before investing to secure your future. This time, we're diving into the incredible story of Rolls-Royce, a symbol of British pride.

In this deep-dive analysis, I explore Rolls-Royce's unique journey and its place in today’s industry landscape. Here’s a look at the key areas covered:

Part 1: Industry Landscape and Rolls-Royce’s Unique Position

This section explores the industries where Rolls-Royce operates: Aerospace, Defence, and Power Systems. Each sector has unique characteristics, and Rolls-Royce’s position in these fields is both significant and distinctive. Here, I delve into what makes each segment vital and why Rolls-Royce stands out.

Part 2: Founding and Growth

In this part, I look back at how Rolls-Royce was founded and grew to become one of the UK’s top companies. With a market cap of around £48 billion, Rolls-Royce has a storied history filled with resilience and innovation. I touch on key moments that shaped its trajectory and how it overcame challenges to reach its current stature.

Part 3: Rolls-Royce’s Business Model

Following the historical context, I dive into Rolls-Royce's business model as it stands today. This section emphasizes how the company’s commitment to continuous innovation is powering its future growth.

Part 4: Business Performance

Perhaps the heart of this analysis, this section delves into the performance of Rolls-Royce’s various business segments. I examine the impact of recent transformations, performance trends, and comparisons with industry peers.

Part 5: Management & Ownership

This part provides a closer look at Rolls-Royce’s management and ownership structure. Rolls-Royce is almost entirely owned by external shareholders, with institutional investors holding nearly 70% of shares, adding an interesting dimension to the company’s governance.

Part 6: Valuation

Here, I explore what expert analysts are saying about Rolls-Royce’s valuation. I analyse the company’s market performance and how it measures up to investor expectations.

Part 7: Transformation, AI Adaptation, and ESG

I start this part with a bold statement: I am not interested in investing in companies that lag in AI or are reluctant to invest in it. In this section, you’ll find a detailed look at Rolls-Royce’s transformation initiatives, AI adaptation, and Environmental, Social, and Governance (ESG) efforts.

Part 8: Stock Screening Test Score

As a long-term investor, I apply a custom stock screening test, developed based on my preferences and research. Here, I present how Rolls-Royce scores according to these criteria.

Part 9: Final Words

In this concluding section, I offer my final thoughts on Rolls-Royce, including some insights into my overall portfolio. This summary reflects on the company’s strengths, opportunities, and what to consider for those thinking of a long-term investment.

This comprehensive analysis gives you a deep understanding of Rolls-Royce, the industry dynamics it navigates, and why it holds such a prominent place in British industry and investment potential

Part 1: Industry Update: Aerospace, Defence, and Power Systems,

(Rolls-Royce's Main Sector)

Before diving into Rolls-Royce's individual business operations, let’s take a step back to understand the industries in which it operates. Rolls-Royce’s business is structured across three main sectors: Aerospace, Defence, and Power Systems. Each has unique characteristics, and understanding them will provide a foundation for why Rolls-Royce is positioned the way it is today. We’ll go into each sector’s role in the company’s broader business model later, but for now, let’s set the scene.

The Early Days of Competition and Innovation

The early 1900s was an era of rapid innovation and fierce competition in the automotive world. Henry Ford’s revolutionary assembly line redefined production and made cars affordable for the masses, while Mercedes-Benz set itself apart as a luxury brand. Renault, meanwhile, developed a name for balancing consumer needs and motorsport reputation. Rolls-Royce entered this competitive space with a focus on craftsmanship, luxury, and impeccable engineering—a philosophy that remains central to the brand today.

Another notable player in luxury and performance vehicles emerged in 1919: Bentley Motors, founded by W.O. Bentley. Bentley aimed to produce cars that were powerful, exhilarating, and built to last, famously saying he wanted his cars to “go the distance.” Bentley’s creations dominated the motorsport scene, especially at the 24 Hours of Le Mans, with five wins between 1924 and 1930. However, as the company pushed boundaries in racing, financial strain crept in.

Rolls-Royce Sees an Opportunity: The Bentley Acquisition

In 1931, as Bentley struggled financially, Rolls-Royce saw an opportunity. Known for producing the "best car in the world," Rolls-Royce was synonymous with British engineering excellence. The acquisition of Bentley was both tactical and transformative. By bringing Bentley into the fold, Rolls-Royce expanded its product range and added Bentley’s motorsport prestige to its own brand, creating a powerful synergy of luxury, reliability, and performance. Under Rolls-Royce’s ownership, Bentley retained its high-performance identity but with the added precision and quality Rolls-Royce was known for. The two brands would eventually go their separate ways in 1998, but the collaboration had laid a foundation of competitive excellence and a legacy of quality that Rolls-Royce carries to this day.

Present-Day Industry Dynamics

Today, the competitive spirit that defined Rolls-Royce’s early years has evolved into three distinct business segments: Aerospace, Defence, and Power Systems. Each segment faces its own market challenges and growth opportunities.

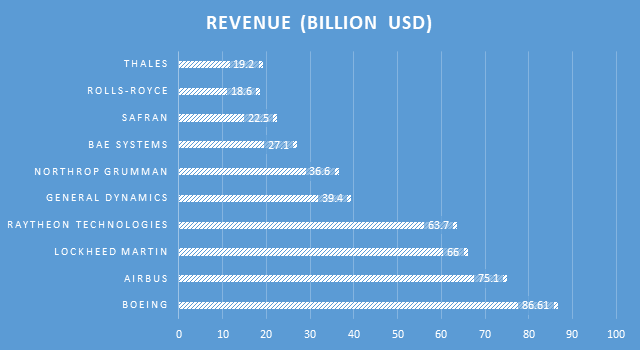

Aerospace & Defence: A Growing Global Market

The aerospace and defence market is booming, and Rolls-Royce is well-placed within this growth. According to PwC’s 2024 report, the global aerospace and defence market achieved $829 billion in revenue in 2023, marking an 11% increase from the previous year. The commercial aerospace sector led this growth, driven by rising air travel demand and advancements in aviation technology. The aircraft order backlog exceeded 14,000 units, creating a strong pipeline of demand for engines and related services. By 2028, the market is projected to grow to around $1.2 trillion, with a compound annual growth rate (CAGR) of 5.8%. North America currently holds the largest market share, benefiting from government support, military modernization, and innovations in lightweight materials.

Rolls-Royce is a critical player in the aerospace segment, especially in the civil aerospace market, which was valued at $324 billion in 2023. Rolls-Royce’s Trent series engines, particularly the Trent 7000 and Trent XWB, power major Airbus and Boeing aircraft, giving the company a substantial market share in widebody aircraft engines. In defence, Rolls-Royce provides engines for military aircraft, naval vessels, and even nuclear submarines, contributing to a $480 billion defence market that is increasingly focused on modernization and technological advancements.

Revenue Chart: Defence market.

Power Systems: Meeting Global Energy and Infrastructure Needs

Rolls-Royce’s Power Systems division, primarily under the mtu brand, focuses on high-speed engines and propulsion systems across marine, rail, defence, and industrial applications. In 2023, this division reported revenues of around €4.56 billion (£3.97 billion), a 16% increase from the previous year, underscoring strong demand in sectors like marine and power generation. Globally, the power management systems market, where Rolls-Royce is a major player, was valued at around $6.13 billion in 2023, with a CAGR of 6.9% expected from 2024 to 2030. Rolls-Royce holds a notable market share of about 15-20% in mission-critical power systems, positioning it well for growth as industries increasingly require robust and efficient power solutions.

Economic, Regulatory, and Technological Factors Shaping the Industry

The aerospace and defence sectors are undergoing significant change. Governments worldwide are implementing stricter emissions regulations, especially in aviation, to address climate change. These regulations are accelerating investment in sustainable aviation fuels (SAF) and alternative energy sources, including hydrogen and electric propulsion. Rolls-Royce has developed the UltraFan engine, which is 25% more fuel-efficient than its predecessors and can operate entirely on SAF. In addition, defence contracts are increasingly focused on environmentally friendly solutions, impacting operational strategies in military divisions.

Technological advances are also reshaping the aerospace and defence industries. Digitalization, artificial intelligence (AI), and electrification are leading to new efficiencies. Rolls-Royce, for instance, uses AI for predictive maintenance, analyzing real-time data to prevent downtime and extend engine lifespan. The company’s investment in battery-electric aircraft and small modular reactors (SMRs) reflects its commitment to meeting regulatory demands and driving innovation in sustainable energy.

Key Market Trends and Shifts

Sustainability and Emerging Technologies

The aerospace industry is increasingly prioritizing sustainability, and Rolls-Royce is leading the way. The company is testing 100% SAF for all its engines, and the UltraFan engine exemplifies its dedication to reducing emissions and enhancing fuel efficiency. This focus on cleaner technology aligns with the industry’s long-term vision of achieving carbon neutrality. Electrification is also a major trend, with Rolls-Royce advancing hybrid-electric propulsion systems and eVTOL (electric vertical take-off and landing) aircraft, pushing the boundaries of sustainable aviation.

Shifts in Global Market Dynamics

Geopolitical tensions, such as the Russia-Ukraine conflict, have spurred increased global defence spending, benefiting Rolls-Royce’s defence business. Demand for advanced military engines and naval propulsion systems is expected to drive growth in this segment as nations modernize their defence capabilities. Additionally, the recovery of global air travel post-pandemic has strengthened Rolls-Royce’s Civil Aerospace business. While narrow-body aircraft rebounded faster, Rolls-Royce’s stronghold in widebody engines positions it well as demand for long-haul travel rises. The growing focus on renewable energy is also driving shifts in the power sector, with Rolls-Royce tapping into markets like microgrids, hydrogen fuel cells, and SMRs.

Competitive Landscape and Rolls-Royce’s Positioning

Key Players and Market Shares

Rolls-Royce faces strong competitors across its main sectors. In aerospace engines, it competes with GE Aviation and Pratt & Whitney, holding around 35% of the widebody engine market with its Trent series engines. In defence, Rolls-Royce’s rivals include industry heavyweights like Lockheed Martin, BAE Systems, and Northrop Grumman. Rolls-Royce’s MTU brand holds a leading position in high-performance engines for various industrial applications, with competitors such as Siemens, Cummins, and Mitsubishi Heavy Industries.

Competitive Strategies

Rolls-Royce has carved a competitive edge through innovation and sustainability. The UltraFan engine, with its superior fuel efficiency, showcases Rolls-Royce’s commitment to greener aviation. Additionally, the company’s TotalCare® program ensures comprehensive maintenance and support services, fostering strong, long-term relationships with customers and creating a steady revenue stream. Strategic partnerships with companies like Airbus and Siemens also strengthen Rolls-Royce’s position in the sustainable aviation market, reducing risk and leveraging shared resources to advance hybrid-electric and alternative fuel technologies.

Rolls-Royce’s Venture into Electrical Aviation

In recent years, Rolls-Royce has expanded into electrical aviation, underscoring its dedication to a sustainable and innovative future. The company’s ACCEL program (Accelerating the Electrification of Flight) has already set a record with the Spirit of Innovation, the world’s fastest all-electric aircraft. This achievement not only marks Rolls-Royce’s leadership in clean aviation technology but also demonstrates its vision for the future.

Rolls-Royce sees electric propulsion playing a pivotal role in reducing carbon emissions for regional and short-haul flights. As urban air mobility becomes a priority for congested cities worldwide, the company is actively developing electric systems that could power a range of aircraft, from air taxis to hybrid-electric regional planes. Through partnerships with leading aerospace firms and continuous investment in innovation, Rolls-Royce aims to make zero-emission, electric-powered flights a reality, paving the way for a quieter, cleaner, and more efficient aviation industry.

Part 2: Rolls-Royce PLC: Business segments and how they have evolved and transformed

Did you know that Rolls-Royce cars—the epitome of luxury and prestige—are not actually produced by Rolls-Royce PLC? While Rolls-Royce is famous for its commitment to precision and quality, the luxury car division was sold in 1998 to BMW, with the Rolls-Royce PLC we know today focusing exclusively on aerospace, defence, and power systems. These two branches of the Rolls-Royce name, while stemming from the same legacy, now serve very different worlds: one caters to the elite on the ground, and the other powers industries in the sky, seas, and energy sectors.

Rolls-Royce PLC, headquartered in London, stands as one of Britain’s engineering titans, with operations across 48 countries and a workforce of over 41,000. While best known for its aerospace engines, the company’s portfolio now extends to defence propulsion and innovative power systems for industries around the world.

A Legacy Forged Through Innovation and Partnership

The story begins with Henry Royce, a dedicated engineer, and Charles Rolls, a car dealer and aviator, whose meeting in 1904 sparked a collaboration that would ultimately shape British engineering. Royce had built his first car that year, and Rolls recognized the quality, performance, and potential it held. Together, they formed Rolls-Royce Limited in 1906, beginning with the production of high-quality automobiles. Their creation, the "Silver Ghost," was hailed as "the best car in the world," a label that would set the standard for the brand's commitment to excellence.

Silver Ghost 1904; Source-Rolls-Royce

As World War I loomed, Rolls-Royce took a transformative step by shifting its focus from cars to aero engines. The government saw Rolls-Royce’s engineering prowess as essential to Britain’s military strategy, and this decision set the foundation for the company's journey into aerospace. This shift marked a pivotal change, as Rolls-Royce’s engines would soon play crucial roles in some of the most famous aircraft in history.

Navigating Challenges and Expanding Horizons

The post-war years saw the company delving deeper into aviation, but challenges were never far away. During the 1970s, Rolls-Royce encountered financial difficulties, largely due to ambitious yet costly projects like the RB211 engine. To stabilize this national treasure, the British government stepped in, nationalizing Rolls-Royce in 1971. The company returned to private ownership in 1987 and began rebuilding, this time with a concentrated focus on aerospace and defence.

By 1998, Rolls-Royce had chosen to part ways with its automotive division, selling it to BMW. With that, Rolls-Royce PLC doubled down on its role as a major player in aviation and engineering for land, air, and sea. In 2011, it made a significant acquisition of Tognum AG—a German powerhouse in high-speed engines and propulsion systems under the MTU brand. This acquisition marked Rolls-Royce’s official entry into the power systems market, offering engines for marine propulsion, power generation, and industrial applications. This move diversified its portfolio, giving it stability and breadth beyond the aviation sector.

History and Founding (Story of innovation and transformation):

Founding: Rolls-Royce was founded in 1904 by Charles Rolls, an automobile dealer, and Henry Royce, an engineer. Their partnership started with Royce designing high-quality cars, which Rolls then marketed under the name "Rolls-Royce." The company quickly gained a reputation for quality and reliability, with the Silver Ghost becoming a symbol of automotive excellence, hailed as "the best car in the world."

Expansion into Aviation: During World War I in 1914, Rolls-Royce expanded into the aviation industry by developing its first aircraft engine, the Eagle. This engine went on to power the first non-stop transatlantic flight in 1919, marking a pivotal shift from luxury automobiles to becoming a major player in the aerospace sector.

World War II: Rolls-Royce's development of the Merlin engine during World War II played a crucial role in the company's history. The Merlin powered the famous Spitfire and Hurricane fighters, which were instrumental in the Battle of Britain, further cementing Rolls-Royce's legacy in both aviation and defence.

Post-War Era and Jet Engines: After the war, Rolls-Royce made significant advances in jet propulsion. It developed the Avon engine, which was used in both military and commercial aircraft, and by the 1950s and 1960s, Rolls-Royce had established itself as a world leader in aviation engines, supplying major airlines and military forces worldwide.

Financial Troubles and Nationalization: In 1971, Rolls-Royce faced severe financial difficulties, largely due to technical challenges with the development of the RB211 engine. This led to the company being nationalized by the British government to ensure its survival. Eventually, Rolls-Royce was privatized again in 1987, forming Rolls-Royce Holdings PLC.

Sale of Motor Car Division to BMW: In the 1990s, Rolls-Royce separated its aerospace and automotive businesses. The motor car division was sold to BMW in 1998, allowing BMW to use the Rolls-Royce brand for automobiles, while Rolls-Royce Holdings PLC continued to focus on aerospace, defence, and power systems.

In 2011 with the acquisition of Tognum AG, a German company renowned for its high-speed engines and propulsion systems under the MTU brand. This strategic move allowed Rolls-Royce to diversify beyond its traditional aerospace and defence operations, establishing a significant presence in the power systems market. In 2014, Tognum AG was rebranded as Rolls-Royce Power Systems AG, solidifying its integration into the Rolls-Royce portfolio.

21st Century and Beyond: In the 21st century, Rolls-Royce expanded into the defence and power systems sectors while maintaining its leadership in civil aerospace. The company began investing in sustainable technologies, including sustainable aviation fuel (SAF) and small modular reactors (SMRs), positioning itself as a pioneer in the decarbonization of air travel and energy systems. Rolls-Royce continues to lead in developing technologies that support sustainability and innovation, shaping the future of aerospace and power generation.

Products and Services of Rolls-Royce PLC:

Rolls-Royce is known for its cutting-edge technology and engineering mastery, bringing power to the skies, the seas, and land through four primary business segments: Civil Aerospace, Defence, Power Systems, and Electric Aviation. Each segment contributes uniquely to the company’s vision of leading the industry in both technological advancement and sustainability.

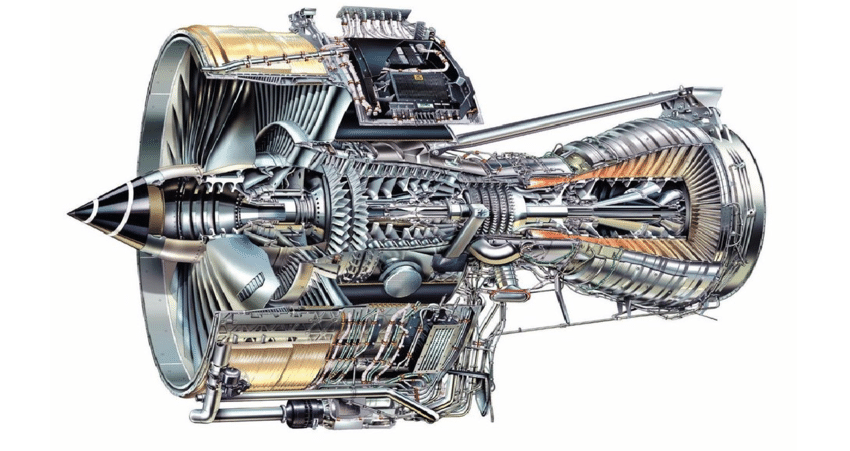

1. Civil Aerospace: Powering the Skies

In the world of commercial aviation, Rolls-Royce is synonymous with high-performance engines that power many of the world’s largest aircraft. Central to this segment is the Trent engine family, known for models like the Trent XWB, which fuels the Airbus A350 and stands as a beacon of reliability and efficiency. These engines are highly prized for their durability and fuel efficiency, which directly support airlines in reducing operational costs and meeting increasingly stringent emissions regulations.

Trent1000 Arero Engine

Rolls-Royce is constantly pushing the boundaries of aerospace engineering with innovations such as the UltraFan engine, designed to enhance fuel efficiency by an impressive 25%. This aligns with the global push towards sustainability, making Rolls-Royce a critical player in the industry’s journey towards greener aviation. As air travel demand rebounds, Rolls-Royce’s reputation for quality and innovation keeps it at the forefront of the civil aerospace sector.

Trent900 TurboFan Engine

2. Defence: Fortifying National Security

In the Defence sector, Rolls-Royce delivers state-of-the-art propulsion systems for a variety of military applications, covering everything from combat and transport aircraft to naval vessels and even nuclear submarines. Its MT30 marine gas turbine, recognized for its high power density and reliability, powers some of the most advanced ships across global navies, including the UK’s own Royal Navy.

Rolls-Royce’s role in the UK’s nuclear submarine program highlights its strategic importance in defence, as these submarines serve as a linchpin in the country’s national security framework. With a focus on reliable and advanced propulsion, Rolls-Royce is not just a supplier but a trusted partner in defence, reinforcing its commitment to supporting military forces worldwide with cutting-edge technology and expertise.

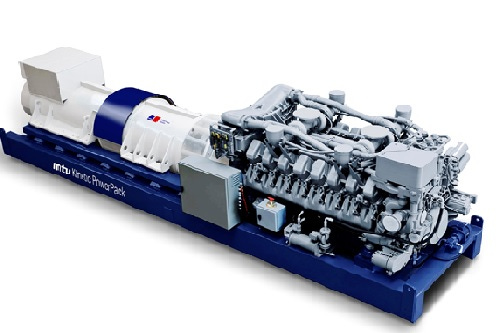

3. Power Systems: Driving the Future of Energy

Through its MTU brand, Rolls-Royce has established a significant presence in power generation, spanning applications across governmental, marine, and industrial sectors. MTU engines and integrated power solutions are tailored to meet the specialized needs of these markets, from high-performance marine engines to systems powering railways and industrial facilities.

Rolls-Royce mtu brand

With a keen eye on the future, Rolls-Royce is investing in sustainable power technologies like microgrids, hydrogen-based energy solutions, and battery storage. As part of the Power Systems division, MTU is advancing its role from a component supplier to a comprehensive solutions provider, particularly for submarines and other mission-critical applications. At the 2024 Euronaval trade fair in Paris, Rolls-Royce introduced the mtu Series 4000 engine for submarines, designed to deliver higher electrical output and rapid battery charging—a feature that allows naval forces to maintain a low profile by reducing time spent on surface charging.

The mtu NautIQ Master automation system, another innovation, brings together propulsion, power management, and critical monitoring systems into a single, streamlined interface. This technology empowers navies to enhance operational efficiency, integrating damage control, navigation, and communications within a unified, user-friendly system. With these advancements, Rolls-Royce’s Power Systems division is redefining what it means to provide mission-critical support, moving beyond mere components to offer holistic solutions for modern naval and industrial demands.

Latest Developed mtu

4. Electric Aviation: Charting a Path to Zero Emissions

Rolls-Royce is pioneering the future of aviation through its Electric Aviation segment, aiming to make zero-emission flights a reality. As urban areas grapple with congestion and air pollution, Rolls-Royce’s electric propulsion systems could become game-changers for short-haul flights and urban air mobility. The ACCEL program, which stands for Accelerating the Electrification of Flight, has already showcased Rolls-Royce’s commitment to this vision.

A testament to the company’s drive for innovation, the ACCEL project’s Spirit of Innovation aircraft recently set a new record as the world’s fastest all-electric plane. This achievement is more than just a milestone; it’s a glimpse into a future where aviation and sustainability can go hand-in-hand. Rolls-Royce envisions electric propulsion playing a crucial role in reducing carbon emissions for regional and short-haul flights, an area poised for growth as cities prioritize cleaner, quieter air travel solutions.

The evolution of Rolls-Royce's products is a testament to their commitment to innovation and excellence.

Early Years: 1904-1930s

· First Motor Car: Henry Royce built his first motor car, the "Royce 10," in 1904.

· Partnership with Charles Rolls: The partnership with Charles Rolls led to the creation of Rolls-Royce Limited in 19061.

· Silver Ghost: The "Silver Ghost" (1907) became an iconic model, known for its reliability and luxury.

Mid-20th Century: 1940s-1980s:

· Aero-Engines: During World War II, Rolls-Royce shifted focus to aero-engines, producing the famous Merlin engine used in Spitfires and Hurricanes.

· Jet Engines: Post-war, Rolls-Royce developed jet engines, including the Avon and Olympus engines.

· Nuclear Submarines: Rolls-Royce became a key supplier for the UK’s nuclear submarine program.

Late 20th Century: 1990s-2000s

· MT30 Marine Gas Turbine: Developed for advanced naval vessels.

· MTU Brand: Rolls-Royce acquired MTU, expanding its power systems portfolio.

21st Century: 2000s-Present

· UltraFan Engine: Aimed at improving fuel efficiency by 25%, the UltraFan engine represents the latest innovation.

· Sustainable Aviation: Rolls-Royce has been pioneering sustainable aviation, including the Trent 1000 engine powering the world’s first 100% sustainable aviation fuel (SAF) transatlantic flight.

· Hydrogen and Battery Solutions: Investing in hydrogen-based solutions and battery storage systems to support clean energy.

Future Innovations

· Net Zero Carbon: Rolls-Royce is committed to achieving net zero carbon emissions, with initiatives like the ACCEL project for zero-emission flight.

· Small Modular Reactors (SMRs): Developing next-generation reactors to meet global energy needs.

· Electrical Aviation: This milestone demonstrates Rolls-Royce's leadership in pushing the boundaries of clean aviation technology.

Customers of Rolls-Royce PLC

Rolls-Royce serves a diverse range of high-profile customers across various industries, including major airlines, military organizations, governments, and large industrial companies. The company’s civil aerospace division provides engines for commercial airlines like Emirates and British Airways, powering over 35% of widebody commercial aircraft globally. In the defence sector, Rolls-Royce partners with military clients such as the UK Ministry of Defence, providing propulsion solutions for aircraft, naval vessels, and submarines. Rolls-Royce also collaborates closely with aircraft manufacturers like Airbus, who integrate Rolls-Royce engines into their planes. In the power systems market, Rolls-Royce’s customers include governments and industrial clients looking for high-performance and reliable energy solutions.

Customer Needs:

Rolls-Royce's customers, whether in aerospace, defence, or power systems, have a core set of needs centered around efficiency, reliability, and after-sales support. Airlines, for instance, demand high-efficiency engines that help reduce fuel costs and emissions, while also ensuring maximum uptime. The TotalCare® service offered by Rolls-Royce is a major differentiator in meeting these needs. TotalCare® provides long-term maintenance, repair, and overhaul services, aligning Rolls-Royce’s financial success with the operational success of its customers. This means that Rolls-Royce is incentivized to keep engines running efficiently and reliably, as their profits are directly tied to the engines' performance.

By offering comprehensive support and advanced technologies, Rolls-Royce is able to foster long-term relationships with its customers, meeting their needs not just for high-quality engines, but also for predictable maintenance costs and operational reliability. This approach has made Rolls-Royce a preferred partner for many of the world’s leading airlines, military forces, and industrial enterprises.

Why I Am Optimistic About Rolls-Royce's Small Modular Reactors (SMRs)

Rolls-Royce has long been known for its innovative engines and power solutions, but its recent strides in clean energy through Small Modular Reactors (SMRs) are opening a new chapter that could be revolutionary—not only for the company but for our planet’s energy future. These aren’t just another source of electricity; Rolls-Royce’s SMRs could play a fundamental role in how we meet global energy demands, all while reducing our carbon footprint.

Let’s take a closer look at why these reactors make me so optimistic.

The Rolls-Royce SMR Program: A New Frontier

In 2021, Rolls-Royce launched a dedicated subsidiary, Rolls-Royce SMR Ltd., to focus entirely on the development of small modular reactors. This is an ambitious move. Each reactor is designed to generate a substantial 470 megawatts (MW) of electricity, enough to power about one million homes. What’s remarkable about these SMRs is their construction approach. Rather than building them entirely on-site like traditional nuclear plants, Rolls-Royce manufactures these reactors in a factory and then transports the components to the site for assembly. This “modular” design doesn’t just save time; it’s also cost-effective and, importantly,

Rolls-Royce SMR process flow: Source-Rolls-Royce web

enhances safety. Each SMR unit costs between £1.8 and £2.3 billion—significantly less than a conventional nuclear power plant—and they’re designed to last a solid 60 years.

Backed by Strong Support and Partnerships

The UK government is firmly behind Rolls-Royce’s SMR initiative. The project has already received £210 million in government funding as part of the UK’s push to achieve net-zero emissions by 2050 and reduce dependence on fossil fuels. Rolls-Royce has also attracted £195 million in private investment from major players like the Qatar Investment Authority, Exelon Generation, and BNF Resources. These funds are vital, providing the capital needed to bring these reactors from concept to a reality that can serve entire regions with clean, reliable energy.

Plans for Deployment and a Growing Global Interest

Right now, Rolls-Royce is navigating the UK’s regulatory approval process for SMRs, a procedure expected to take about 4-5 years. If everything proceeds as planned, we could see the first reactors deployed by the early 2030s. Rolls-Royce is already scouting potential locations across the UK for these reactors and is actively in discussions with utility companies about partnerships.

But here’s where it gets even more interesting: the demand isn’t just within the UK. Countries worldwide are eyeing Rolls-Royce’s SMR technology as an ideal path toward a cleaner energy future. The United States, Canada, and Poland have all shown strong interest, viewing SMRs as a viable alternative to fossil fuels. Rolls-Royce’s SMRs are emerging as an attractive export product, with the potential to power nations across the globe sustainably.

Why SMRs Are So Vital

Let’s talk about the “why” behind SMRs and their appeal.

Decarbonization: The world is urgently working to cut down on carbon emissions. Renewable energy sources, like wind and solar, are key players in this mission, but they have a natural unpredictability—energy production fluctuates with the weather. SMRs provide a steady, low-carbon energy source, capable of supporting renewables by delivering power consistently, even when the sun isn’t shining or the wind isn’t blowing.

Energy Security: As nations look to reduce their dependence on imported fossil fuels, SMRs offer a safe, efficient, and cost-effective solution. The modular design allows them to be produced in a factory and then assembled on-site, making them far simpler and faster to deploy than traditional nuclear plants. This is a significant advantage, especially when countries face urgent energy needs.

SMRs and Hydrogen Production: A Powerful Synergy

Beyond generating electricity, Rolls-Royce is exploring ways to use SMRs for hydrogen production—a critical component for clean energy in industries like transportation and heavy manufacturing. Producing hydrogen through nuclear power creates a valuable new revenue stream for Rolls-Royce while supporting global decarbonization goals. In essence, SMRs open the door for Rolls-Royce to be a leader not only in electricity production but also in clean industrial fuel.

The Bigger Picture: Addressing Global Energy Needs

Today, coal still accounts for about 36% of global electricity generation, and it’s responsible for roughly 30% of energy-related CO₂ emissions—the largest single contributor to emissions. Even though renewables are on the rise, they now cover about 29% of global electricity needs. Replacing coal remains a tremendous challenge, especially in regions where infrastructure may not yet support renewable energy effectively. This is where SMRs can step in, providing a reliable, clean energy solution that helps bridge the gap where renewables alone may not suffice.

Moreover, while approximately 91% of the world’s population has access to electricity, many regions, particularly in Sub-Saharan Africa and South Asia, still experience frequent outages and unreliable service. SMRs could offer a stable and dependable electricity source to these underserved areas, improving the quality of life and supporting economic growth.

A Long-Term Vision: Net-Zero and Beyond

Rolls-Royce’s SMR project is more than just a technological innovation; it’s a vital step towards a sustainable energy future. With strong backing from the UK government, substantial private investment, and an eye on international deployment, Rolls-Royce has positioned itself as a leader in the nuclear energy space. If these reactors scale as planned, SMRs will not only aid in reducing global CO₂ emissions but also provide Rolls-Royce with a solid and future-proof revenue stream. It’s a bold, long-term vision that aligns with both the company’s growth strategy and the world’s environmental needs.

Strategic Partnerships in Europe: The Czech Connection

In a promising partnership, Rolls-Royce SMR Limited and the ČEZ Group have joined forces to advance SMR deployment in both the UK and Czechia. ČEZ has taken a strategic equity stake in Rolls-Royce SMR, acquiring around 20%. Together, they aim to develop up to 3 GW of clean power in the Czech Republic, with preliminary work beginning as soon as 2025. Beyond this partnership, Rolls-Royce’s SMR team is prepared to support future SMR projects throughout Europe.

This collaboration highlights the UK’s and Czechia’s shared vision for sustainable and affordable electricity, with each SMR generating 470 MWe of carbon-free power—enough to supply one million homes for over 60 years. This partnership signals not only a commitment to clean energy but also a step towards an interconnected European energy future.

The Path Forward

Rolls-Royce’s SMR project is an impressive leap towards meeting the world’s energy needs sustainably. As nations commit to net-zero goals and look to secure energy independence, Rolls-Royce’s SMRs could provide an indispensable solution. With powerful backing from both government and private investors, this isn’t just an exciting development for Rolls-Royce but a key piece in the global clean energy puzzle. If these reactors can reach scale, they’ll provide a dependable, environmentally friendly power source, solidifying Rolls-Royce’s role in shaping a sustainable future.

Future Potential of Rolls-Royce Holdings PLC

Rolls-Royce is standing at the edge of a new, exciting era. With the world leaning heavily towards sustainability, this century-old engineering giant seems perfectly poised to make its mark across the aerospace, defence, and energy sectors. Its solid foothold in these industries, combined with a bold strategy focused on green technology, has created ample room for future expansion. Yet, it’s not a clear path forward—Rolls-Royce will need to skillfully steer through market changes, intense competition, and an evolving regulatory landscape to secure its place in the future.

At the heart of Rolls-Royce's strength lies its commanding market share in its core sectors. In the world of Civil Aerospace, Rolls-Royce holds around 35% of the widebody aircraft engine market. Their Trent engine family, a range that powers planes like the Airbus A350 and Boeing 787, has anchored Rolls-Royce firmly in long-haul aviation, an area poised for growth as global travel recovers. Defence, too, is an arena where Rolls-Royce commands respect, with its engines powering everything from naval vessels to military aircraft. The company’s involvement in high-stakes defence projects, like the Global Combat Air Programme and the AUKUS submarine initiative, has further cemented its critical role in military and naval propulsion, especially within the UK and with key global partners. In Power Systems, Rolls-Royce’s mtu brand has carved out a significant share in power generation and microgrid technology. As demand for sustainable energy solutions rises, mtu’s market share continues to grow, with products that include battery storage and hydrogen-powered systems, showcasing Rolls-Royce's commitment to green power technology.

One of the company’s most significant competitive advantages is its strength in the widebody engine market, a space where its dominance allows it to stay ahead of competitors focused on narrowbody solutions, like GE Aviation. Additionally, Rolls-Royce’s robust defence contracts ensure a steady revenue stream that offers resilience against economic ups and downs. The company’s investments in sustainable aviation fuel (SAF), electric propulsion, and small modular reactors (SMRs) only add to its competitive edge, aligning perfectly with global industries’ shift toward greener solutions.

Sustainability and green technology are, without question, powerful drivers of Rolls-Royce’s growth. The soon-to-be-released UltraFan engine promises to boost fuel efficiency by 25% over previous models. With ongoing work in SAF and electric propulsion, Rolls-Royce is solidifying its place in the future of sustainable aviation. Meanwhile, its focus on SMRs positions it as a key player in clean nuclear energy, aligning with the global shift toward decarbonization and setting up long-term growth opportunities in energy.

In Civil Aerospace, Rolls-Royce stands to benefit greatly from the recovery of the aviation industry. Long-haul travel, which took a heavy hit during the pandemic, is expected to return to pre-pandemic levels by 2024. This recovery promises not only a rise in new aircraft demand but also a resurgence in aftermarket services. Rolls-Royce’s TotalCare® program, which offers airlines long-term maintenance and fleet life extension, will be pivotal in meeting these demands, further driving Rolls-Royce’s growth as airlines look for reliable, efficient service options.

Defence budgets, driven by shifting geopolitics, are also on the rise, and Rolls-Royce is well-positioned to benefit. Its involvement in large-scale defence projects, from propulsion systems for combat aircraft to nuclear-powered submarines, keeps it at the forefront as nations prioritize military modernization. The Global Combat Air Programme (GCAP), a partnership involving the UK, Italy, and Japan, will further boost Rolls-Royce’s position in the defence market.

Another growth area is Rolls-Royce’s investment in digital and predictive technologies. Through AI and predictive maintenance, the company optimizes engine performance, enabling real-time monitoring and efficient scheduling, which reduces downtime and enhances customer service. Staying at the cutting edge of digital innovation strengthens Rolls-Royce’s aftermarket offerings, giving customers more value and reinforcing customer loyalty.

Of course, with opportunity comes risk. Rolls-Royce’s Civil Aerospace division is sensitive to economic fluctuations, as seen during the COVID-19 pandemic, when the sudden halt in travel highlighted just how vulnerable this sector can be. Any future downturn could once again impact profitability in this division. Moreover, Rolls-Royce faces fierce competition from industry giants like GE Aviation, Pratt & Whitney, and Safran in aerospace, and from Siemens and Cummins in power systems. Competitors are racing forward with green technologies, especially in SAF and electric propulsion, and Rolls-Royce must keep pace or risk losing ground.

The regulatory environment also poses challenges. As environmental standards tighten worldwide, Rolls-Royce must adapt quickly. Delays and increased costs from global supply chain issues add another layer of risk, affecting the timely delivery of products and profitability. Additionally, technological disruption is looming on the horizon. As the market turns to electric aircraft, Rolls-Royce will need to innovate rapidly to secure its position, particularly in the small and medium aircraft segments, where electric solutions are becoming more viable.

The global aerospace industry, however, is expected to grow at a compound annual rate of 5.8%, reaching over $1 trillion by 2030. Rolls-Royce’s strength in widebody engines positions it well to capture this growth, driven by renewed demand for air travel and aftermarket services. Similarly, the global defence sector is expanding at a 4% annual rate, fueled by rising security concerns, while the renewable energy market is projected to grow at 7% annually as demand for nuclear energy and green solutions increases. Rolls-Royce’s investments in SMRs and hydrogen propulsion make it well-prepared to seize opportunities in these expanding markets.

Rolls-Royce’s commitment to sustainable aviation and energy technologies positions it to benefit greatly from global decarbonization efforts. These strategic investments are likely to fuel the company’s long-term growth as industries shift toward reducing carbon emissions. The recovery in long-haul travel will further bolster Rolls-Royce’s position, as demand for new widebody aircraft and aftermarket services returns to pre-pandemic levels. Rising defence budgets also promise sustained revenue growth through critical projects like GCAP and the AUKUS initiative.

Rolls-Royce is indeed uniquely poised for a future that emphasizes sustainability, resilience, and innovation. The company’s position as a leader in widebody aircraft engines, a critical player in military propulsion, and a pioneer in green technologies anchors it firmly in a promising future. However, navigating the inevitable challenges—market volatility, intense competition, and regulatory hurdles—will require strategic agility and careful execution.

If Rolls-Royce can deliver on its sustainability commitments, strengthen its defence capabilities, and maintain its edge in power systems, the future looks bright. With the right balance of innovation and financial prudence, Rolls-Royce could secure its place as a leader not only in aerospace and defence but also as a key player in the next generation of sustainable energy.

How Restructuring Will Affect Future Growth

Rolls-Royce has embarked on a transformative journey, spurred by the challenges that emerged during the COVID-19 pandemic. This restructuring marks a bold step to reshape the company’s future, making it leaner, more agile, and resilient. Through a series of strategic shifts, Rolls-Royce aims to cut costs, focus on high-growth segments, and fuel innovation in emerging technologies, setting the stage for a sustainable and resilient future.

To withstand the volatility of the aerospace industry, Rolls-Royce took significant cost-cutting measures, including reducing its workforce by approximately 9,000 employees, streamlining manufacturing, and consolidating production sites. These moves generated £1.3 billion in annual savings, strengthening Rolls-Royce's financial health and creating flexibility to reinvest in core areas. Now, the company can direct resources more effectively into research and development, innovative projects, and high-potential business segments, ensuring it stays nimble and competitive in a rapidly changing market.

This restructuring also sharpened Rolls-Royce’s focus on key growth segments, especially Civil Aerospace, which took a severe hit during the pandemic. With global air travel recovering, Rolls-Royce is well-positioned to capture new demand. With a renewed financial foundation, the company can now invest in future-ready technologies like the UltraFan engine, which promises a 25% increase in fuel efficiency—an enticing feature for airlines looking to cut costs and emissions. Meanwhile, the Power Systems segment is set to benefit from the restructuring as well, with increased resources directed toward expanding into microgrids, hydrogen fuel cells, and renewable energy solutions. This shift opens doors to new revenue streams in sustainable energy markets, tapping into the global demand for clean and reliable energy.

With newfound capital, Rolls-Royce is making a concerted push toward sustainable technologies. Its strides in Sustainable Aviation Fuel (SAF) have positioned it as a key choice for airlines aiming to reduce emissions. Beyond aviation, Rolls-Royce’s commitment to Small Modular Reactors (SMRs) in the energy sector offers a glimpse into the future of clean nuclear power. Supported by government and private investment, these reactors are anticipated to provide 470 MW of power—enough to power a small city—meeting the rising demand for low-carbon energy solutions. This investment in hybrid propulsion and electric take-off and landing (eVTOL) technology also paves the way for new ventures in urban air mobility, a sector gaining traction as cities seek to reduce congestion and emissions.

The restructuring has significantly improved Rolls-Royce’s cash flow, giving it a financial cushion for future investments and innovation. By 2023, the company’s free cash flow reached £1.49 billion, creating room for strategic partnerships and potential acquisitions to bolster its market position. Moreover, Rolls-Royce’s debt has been reduced from £7.5 billion in 2021 to £4.9 billion in 2023, lowering interest costs and boosting profitability. This healthier balance sheet not only improves Rolls-Royce’s credit standing but also reduces the cost of raising capital, should it be needed to fund future growth.

In its realignment, Rolls-Royce has doubled down on its core strengths: aerospace, defence, and power systems. Divesting non-core assets like ITP Aero has brought in additional cash, allowing Rolls-Royce to focus on areas with the highest growth potential. This strategic refocusing means Rolls-Royce can drive innovation and respond to market demands more swiftly in segments where it holds deep expertise.

The restructuring has also strengthened Rolls-Royce’s ability to compete against industry giants like GE Aviation and Pratt & Whitney. By emphasizing aftermarket services, particularly through its TotalCare® agreements, Rolls-Royce enhances customer loyalty and secures a stable revenue stream. Cost efficiencies and investments in sustainable aviation—exemplified by the UltraFan engine—further position Rolls-Royce to capture a larger share of the widebody aircraft market, where it already commands a significant presence.

Moreover, the restructuring has allowed Rolls-Royce to align its strategies with environmental, social, and governance (ESG) goals. Through investments in SAF, SMRs, hybrid propulsion, and electrification, Rolls-Royce is actively pursuing a transition to net-zero emissions. This alignment not only enhances the company’s appeal to sustainability-conscious investors and customers but also opens up new opportunities in the decarbonization movement, positioning Rolls-Royce as a leader in green technology.

In the broader industry, this restructuring echoes similar moves by Rolls-Royce’s competitors, such as GE Aviation, Pratt & Whitney, and Safran, each of which responded uniquely to the challenges brought by the pandemic. While all these companies have pursued cost efficiency, defence diversification, and sustainability goals, their approaches have varied. GE Aviation, for instance, reduced its workforce and restructured its divisions, while Pratt & Whitney, within Raytheon Technologies, aimed at cutting redundancies post-merger. Safran engaged in workforce adjustments as well but took a conservative approach, particularly in its propulsion and equipment sectors. Rolls-Royce’s restructuring, however, was particularly impactful due to its high reliance on the civil aerospace market, which was more severely affected by the pandemic than defence-focused segments.

A significant highlight of Rolls-Royce’s restructuring is its strong commitment to sustainability. By investing in SAF, hybrid propulsion, and SMRs, the company is setting itself apart in the green technology race. Its UltraFan engine, which promises to improve fuel efficiency by 25%, is a testament to Rolls-Royce’s ambitions in sustainable aviation. While competitors like GE and Safran have also prioritized sustainability, focusing on hybrid-electric propulsion, Rolls-Royce’s foray into nuclear power with SMRs is unique. This focus on SMRs gives Rolls-Royce a broader growth avenue beyond aerospace, positioning it as a leader in the sustainable energy landscape.

Rolls-Royce has also reinforced its Defence and Power Systems segments to mitigate the cyclical nature of the civil aerospace market. This strategic diversification into defence and decentralized energy solutions, like microgrids and hydrogen fuel cells, strengthens the company’s resilience. Competitors have taken similar approaches, with GE’s restructuring focusing on aviation while leveraging its military portfolio for stability. Pratt & Whitney, under Raytheon, benefits from a diverse defence footprint, and Safran has balanced commercial risks with defence exposure. Rolls-Royce’s unique focus on Power Systems broadens its reach even further, distinguishing it with a solid footing in renewable energy markets.

Debt management has also been a focus across the industry, and Rolls-Royce’s efforts to reduce long-term debt have set it apart. While GE pursued deleveraging through spin-offs, and Safran maintained moderate debt levels, Rolls-Royce’s improved cash flow positions it for secure future investments. This financial strength offers flexibility, should the company need to respond to new market demands or capitalize on emerging opportunities.

In comparing these restructuring strategies, a few key points stand out. First, Rolls-Royce’s reduction in costs has been substantial, mirroring actions taken by GE and Pratt & Whitney, but with a greater focus on civil aerospace recovery. Second, while all companies have made strides in sustainable technology, Rolls-Royce’s venture into nuclear energy with SMRs offers a unique growth path outside of traditional aerospace markets. Third, while all players have fortified their defence sectors, Rolls-Royce’s Power Systems diversification offers additional revenue stability. Lastly, Rolls-Royce’s focus on debt reduction and cash flow has set it up well for financial resilience and future investments.

Rolls-Royce’s restructuring aligns closely with industry trends of cost efficiency, sustainability, and diversification. By focusing on SMRs, Power Systems, and sustainable aviation, Rolls-Royce has positioned itself uniquely among its competitors. This strategic overhaul has laid a strong foundation for Rolls-Royce’s growth in both aviation and sustainable energy, setting it on a path toward robust future expansion in these high-potential markets.

Part 3: Rolls-Royce PLC: Business Models

Rolls-Royce's Business Model is built on a combination of equipment sales and aftermarket services, providing a balanced approach to revenue generation and sustained customer engagement.

Revenue and Profit Generation:

Rolls-Royce generates revenue from two primary sources: the sale of original equipment (including gas turbines and propulsion systems) and aftermarket services like long-term maintenance contracts under the TotalCare® program. The sale of original equipment, such as aircraft engines and power systems, provides significant initial revenue, particularly for aerospace and defence clients. However, the company's business model is heavily supported by its service agreements, such as TotalCare®, which tie ongoing revenue to the actual usage of the engines. These maintenance contracts are designed to ensure that Rolls-Royce continues to profit from engine utilization, incentivizing both the company and customers to focus on engine uptime and optimal performance.

Core Activities:

Rolls-Royce's core activities include the design, development, manufacturing, and maintenance of power systems across three major segments: civil aerospace, defence, and power generation. In the civil aerospace sector, Rolls-Royce is involved in the production of engines for commercial and business aircraft, while in the defence sector, it provides propulsion solutions for military aircraft, ships, and submarines. The power generation segment focuses on providing solutions such as microgrids and power systems for various applications. Rolls-Royce also invests heavily in research and development (R&D) to foster innovation in sustainable technologies, including electric propulsion systems, sustainable aviation fuel (SAF), and small modular reactors (SMRs). This focus on R&D allows Rolls-Royce to stay ahead in an industry that increasingly demands sustainable and innovative power solutions.

Value Proposition:

The value Rolls-Royce offers to its customers lies in the reliability, fuel efficiency, and cutting-edge technology of its engines and power systems. Rolls-Royce engines are renowned for their advanced engineering and efficiency, which help reduce fuel consumption and operating costs for airlines and defence clients. The company’s global service network is another key part of its value proposition, offering comprehensive support to customers throughout the lifecycle of the product. By leveraging TotalCare® and other long-term service agreements, Rolls-Royce builds enduring relationships with its customers, providing assurance of performance optimization and maintenance predictability.

Key Metrics and Analysis of Rolls-Royce PLC's Performance

Rolls-Royce’s recent performance tells a story of resilience and growth. In 2023, the company reported underlying revenue at £15.4 billion, a notable increase from £12.7 billion in 2022, marking a 21% growth rate. The momentum didn’t stop there; by the first half of 2024, revenue climbed further to £8.2 billion—a 19% increase compared to the same period in the previous year. This resurgence was driven by a strong recovery in the Civil Aerospace sector post-pandemic, complemented by heightened activity in Power Systems and Defence.

In terms of profitability, Rolls-Royce experienced a remarkable boost. The underlying operating profit rose from £652 million in 2022 to £1.6 billion in 2023, and this trend continued in 2024, with a £1.1 billion profit in the first half—an impressive 74% jump over the previous year’s half-year result. This growth in operating profit reflects CEO Tufan Erginbilgic’s focused transformation strategy, emphasizing cost control, operational efficiency, and stronger commercial terms. The operating margin also saw a significant improvement, climbing from 9.7% in the first half of 2023 to 14.0% in 2024, underscoring the impact of these strategic adjustments.

Rolls-Royce has firmly secured its place in the widebody aircraft engine market, maintaining approximately 35% of market share and competing with industry heavyweights like GE Aviation and Pratt & Whitney. Their Trent engines, particularly the Trent XWB that powers the Airbus A350, highlight Rolls-Royce’s excellence in efficiency and reliability, which have become hallmarks of the brand. This strong market presence is further reinforced by their aftermarket services, like the TotalCare® program, which enhances customer retention by aligning Rolls-Royce’s financial interests with the operational success of its customers, offering them long-term maintenance, repair, and overhaul services. This approach has created a dependable revenue stream, appealing to airlines and defence clients who value reliability and cost predictability.

The company’s overall financial health appears robust across several key indicators. Rolls-Royce experienced consistent revenue growth, reflecting its ability to capitalize on post-pandemic opportunities. With profitability improving and free cash flow reaching £1.2 billion in the first half of 2024 (up from £0.4 billion in the first half of 2023), Rolls-Royce gained flexibility to invest in strategic projects and reduce debt. Additionally, the return on capital climbed to 13.8%, showing more efficient use of resources to generate profits.

Each of Rolls-Royce’s divisions is contributing positively to its performance. Civil Aerospace reported an 18% operating margin in early 2024, benefiting from increased demand in the business aviation sector and higher profits from aftermarket services. The Defence division, with an operating margin of 15.5%, reflected strong demand for military engines and submarine systems. Meanwhile, Power Systems reported a 10.3% margin driven by demand for power generation systems, particularly for data centers and other critical infrastructure. This positive outlook has led Rolls-Royce to raise its full-year guidance for 2024, expecting an operating profit of £2.1 billion to £2.3 billion and free cash flow between £2.1 billion and £2.2 billion.

Rolls-Royce’s unique edge comes from its continuous evolution across Civil Aerospace, Defence, and Power Systems. In Civil Aerospace, the Trent engines solidify its market position, earning the trust of major airlines and aircraft manufacturers. Rolls-Royce’s role in Defence is equally pivotal, especially with alliances like the AUKUS partnership. In Power Systems, Rolls-Royce is building a competitive advantage with high-performance engines, microgrids, and energy storage solutions, all while embracing sustainable technologies like hydrogen-powered systems.

Rolls-Royce’s technological prowess is indisputable, with the Trent XWB engine standing as one of the most efficient widebody engines and the UltraFan promising a 25% increase in fuel efficiency. Their TotalCare® service agreements generate reliable revenue from maintenance and repair, which helps stabilize income in the face of cyclical new engine sales. In Defence, long-term contracts provide predictable revenue, securing Rolls-Royce’s critical role in national security programs like the UK’s nuclear submarine fleet and the Global Combat Air Programme (GCAP). Rolls-Royce’s investments in sustainable aviation fuel (SAF), electric propulsion, and small modular reactors (SMRs) reflect a forward-looking focus, keeping it aligned with the green transition sweeping across industries.

Despite these strengths, Rolls-Royce faces challenges. Its absence in the narrowbody aircraft market is a gap, particularly since this segment rebounded faster post-pandemic. Financially, the pandemic pushed its debt-to-equity ratio to a high of 3.0, though it has since dropped to 1.9. High debt can strain investment capacity, which is critical for a company in constant pursuit of innovation.

The global landscape offers fertile ground for Rolls-Royce’s continued growth. As air travel resumes, demand for aftermarket services like TotalCare® will likely rise. Global decarbonization efforts open new avenues for Rolls-Royce in hydrogen propulsion, electric aircraft, and SMRs, aligning with the company’s growing focus on sustainability. Rising defence budgets offer additional opportunities, but competition is fierce. Giants like GE and Siemens are advancing in green energy, presenting direct challenges. Supply chain constraints, especially in aerospace, also pose risks to contract fulfillment and profit margins.

However, Rolls-Royce’s entrenched position in aerospace and defence provides a buffer against new entrants. Established supplier relationships and a loyal customer base mitigate some volatility. The Defence division benefits from government contracts that ensure stability, though government clients can exert significant bargaining power. Rolls-Royce’s foresight, evidenced by recent divestitures and sustainable technology investments, positions it to capitalize on emerging trends.

Strategic divestitures, like the sale of ITP Aero, helped reduce debt while boosting liquidity, allowing Rolls-Royce to focus on sustainable investments in SAF, SMRs, and hydrogen propulsion. Their partnerships with industry giants like Airbus in hybrid-electric propulsion further showcase a collaborative approach to R&D. The TotalCare® program, with revenue projected to exceed 50% of Civil Aerospace’s total earnings as air travel rebounds, reinforces their strategy of maintaining stable income from services.

Looking ahead, Rolls-Royce is primed to leverage both technological strengths and market trends. Their restructuring efforts and sustainability pivot have strengthened their financial foundation. But as competitors rapidly advance in green energy, Rolls-Royce will need to continuously innovate, especially in after-market services, to stay competitive in an evolving landscape.

The cyclical nature of civil aerospace revenues presents vulnerabilities, as shown by the pandemic’s impact. Complicated global supply chains amplify these weaknesses, with disruptions revealing vulnerabilities in the company’s reliance on widebody aircraft, which are recovering more slowly than narrowbodies. However, Rolls-Royce is well-positioned to benefit from the growing demand for sustainable aviation and rising defence budgets. Ventures into SMRs also underscore Rolls-Royce’s clean energy ambitions, and partnerships with Airbus and Siemens in electric propulsion place them at the forefront of electric aviation.

With these opportunities come risks. Economic downturns or uncertainties can reduce spending in the airline and defence sectors, impacting Rolls-Royce’s profitability. Intense competition from GE Aviation and Pratt & Whitney in aerospace and Siemens, Cummins, and Mitsubishi in power systems will require continuous investment and innovation. Regulatory shifts towards sustainability add pressure to accelerate green initiatives, which can increase costs. Finally, technological disruption is imminent, as electric aircraft gain traction, especially in small and medium segments.

Rolls-Royce remains a prestigious player in aerospace and defence, overcoming financial hurdles through its focus on sustainable technology, defence expansion, and clean energy solutions like SMRs. The company’s long-term success will depend on its ability to adapt and capitalize on new opportunities while managing the complexities of a fast-evolving industry.

Part 4: Rolls-Royce Performance Analysis: 2019-2023

Overall Performance

Over the last five years, Rolls-Royce has navigated significant transformations, influenced by both internal restructuring and external market dynamics, particularly due to the COVID-19 pandemic’s impact on the aerospace industry. By 2023, the company demonstrated remarkable financial improvement, achieving underlying revenue growth of 21% to £15.4 billion from £12.7 billion in 2022, with free cash flow surging to £1,285 million from £505 million the previous yearround reflects Rolls-Royce’s commitment to cost control, operational efficiency, and selective investments in high-growth areas such as sustainable power systems and defense contracts.

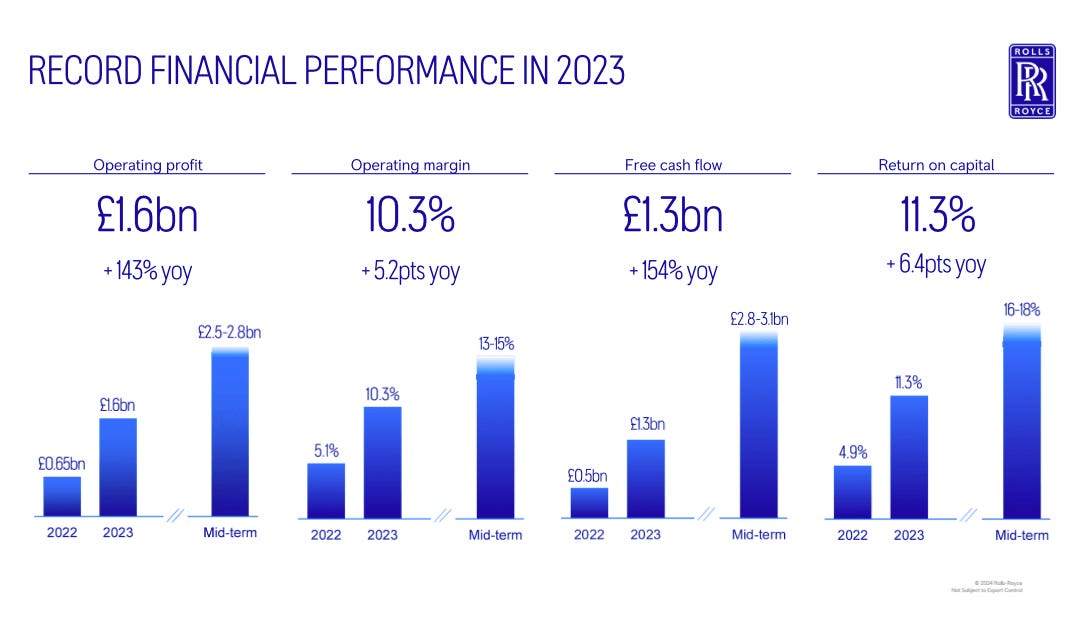

2023 Performance, Source: Rolls-Royce

The company’s reduction of its net debt from £3.25 billion in 2022 to £1.95 billion in 2023 is a notable achievement, enhancing financial flexibility and stabilizing its balance sheet . The busintion efforts have solidified Rolls-Royce’s footing in sectors that promise sustainable growth, positioning it for future expansion in a rapidly changing global landscape.

Business Segment Performance

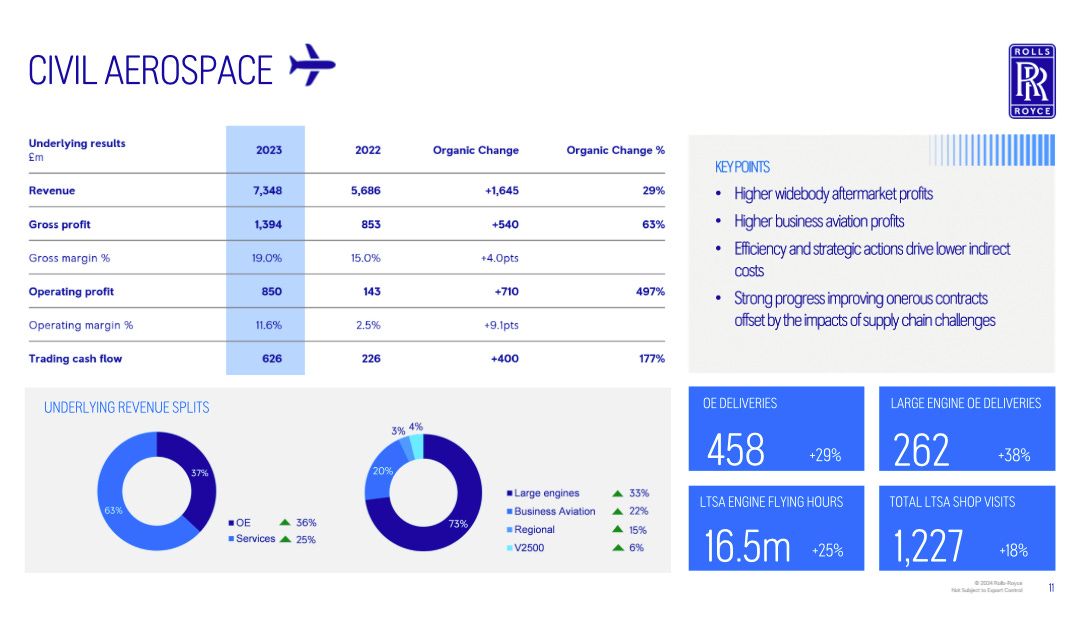

Civil Aerospace

Rolls-Royce’s Civil Aerospace division remains its largest revenue contributor, particularly with the success of its Trent engine series, which dominates the widebody market. In 2023, this segment reported an impressive revenue increase to £7.35 billion, up from £5.69 billion in 2022, driven by a recovery in global air travel and strong demand for widebody aircraft . As a key player in seraul aircraft, the Civil Aerospace division has benefitted from Rolls-Royce’s innovative TotalCare® maintenance program, which has not only enhanced recurring revenues but also built long-term customer relationships.

The launch of the UltraFan engine, which promises 25% fuel efficiency improvements over prior models, highlights Rolls-Royce’s dedication to sustainability and operational efficiency. Cash flow for this segment saw a marked improvement, reaching £626 million due to higher operating profit, strategic inventory management, and increased flying hours.

Defense

Rolls-Royce’s resilience and steady growth, supported by significant long-term government contracts and strategic involvement in defense projects across the globe. The division’s revenue reached £4.08 billion in 2023, up from £3.66 billion in 2022, benefiting from increasing global defense budgets . Rolls-Royce’s unique capabilities in nuclear propulsion fos and combat propulsion systems have fortified its market position, with key projects such as the UK’s Global Combat Air Programme (GCAP) and the AUKUS submarine project ensuring continued revenue streams.

This segment’s operating profit grew by 13.8% in 2023, underscoring the importance of defense contracts as a stable revenue source. The U.S. Army’s Future Long-Range Assault Aircraft (FLRAA) program, powered by Rolls-Royce engines, is among the recent major wins, reinforcing the company’s reputation as a reliable defense supplier .

Power Systems

Through its MTU brand, Rolls-Royce’s Power Sl player in power generation, propulsion, and energy storage solutions, focusing on high-growth markets like data centers and decentralized energy systems. In 2023, the segment’s revenue grew by 16% to £4 billion, driven by strong demand for power generation solutions, especially in data centers where Rolls-Royce has a leading position .

The segment has also embraced the shift to sustainable energy with investments in battery ensystems (BESS) and hydrogen fuel technologies. The 10.4% operating margin improvement reflects efforts to optimize value-based pricing, streamline operations, and boost service offerings .

New Markets

The New Markets division, an area focused on future technologies such as Small ModulMRs) and electric propulsion, represents Rolls-Royce’s commitment to pioneering sustainable power solutions. Although still in its early stages, the segment posted £4 million in revenue with an operating loss of £160 million, indicating heavy investment in research and development .

SMRs, which are compact nuclear reactors intended to produce low-cost, emission-free electricity, are central to thisategy. Rolls-Royce’s advancements in SMR technology, including securing UK government backing and international partnerships, signify its leadership in next-generation clean energy solutions. With expectations for commercial scalability by the early 2030s, SMRs position Rolls-Royce for long-term growth in the global shift toward decarbonization .

Rolls-Royce’s overall performance and segment-wise advancements illustrate a company in a strategic transition,owth through innovative technologies and long-term service agreements. Civil Aerospace leads the revenue charge with its Trent engines and UltraFan development, while Defense provides stability through substantial government contracts. Power Systems continues to expand into renewable and decentralized energy, and New Markets is pioneering sustainable technologies with immense potential for future revenue. Rolls-Royce’s restructuring has bolstered financial health, positioning it to capitalize on industry shifts towards sustainability, defense expansion, and clean energy.

Business Segment Analysis (2019-2023):

Civil Aerospace:

2019: The segment generated £8.1 billion in underlying revenue, benefiting from strong demand for widebody aircraft engines.

2020: Revenue declined to £5.1 billion due to reduced air travel and deferred orders amid the pandemic.

2021: A further decrease to £4.5 billion was observed, reflecting ongoing challenges in the aviation industry.

2022: The segment rebounded to £5.7 billion, supported by increased engine flying hours and aftermarket services.

2023: Revenue rose to £7.2 billion, driven by a recovery in long-haul travel and strategic initiatives to enhance service offerings.

Defence:

2019: The Defence segment reported £3.2 billion in revenue, maintaining a stable performance with key contracts.

2020: Revenue slightly decreased to £3.0 billion, impacted by project delays and budget constraints.

2021: The segment recovered to £3.4 billion, benefiting from new contracts and increased defence spending.

2022: Revenue remained steady at £3.7 billion, with continued support from government contracts.

2023: The segment achieved £3.9 billion in revenue, reflecting growth in military aerospace and naval propulsion systems.

Power Systems:

2019: Power Systems contributed £3.3 billion in revenue, driven by demand in power generation and marine applications.

2020: Revenue declined to £2.7 billion due to disruptions in industrial sectors.

2021: The segment rebounded to £3.3 billion, supported by recovery in key markets.

2022: Revenue increased to £3.3 billion, with growth in sustainable power solutions.

2023: The segment reported £3.5 billion in revenue, reflecting expansion in energy storage and microgrid solutions.

Revenue Growth Comparison Across Segments:

Over the five-year period, the Civil Aerospace segment exhibited the most significant fluctuations, with a sharp decline during the pandemic and a robust recovery thereafter. The Defence segment demonstrated resilience, maintaining steady growth despite external challenges. Power Systems showed consistent performance, with gradual growth driven by diversification into sustainable energy solutions.

In summary, Rolls-Royce's performance over the past five years reflects its ability to adapt to challenging circumstances through strategic restructuring and a focus on core business segments. The company's emphasis on innovation and sustainability positions it well for future growth across its diverse portfolio.

Rolls-Royce Debt Management Strategy (2019-2023)